The Apt Differs From the Capm Because the Apt

Another difference is that in APT the performance of the asset is. The arbitrage pricing theory APT differs from the single-factor capital asset pricing model CAPM because the APTa.

Differentiate Between Arbitrage Pricing And Capital Asset Pricing Theory Qs Study

The feature of the APT that offers the greatest potential advantage over the CAPM is the.

. The CAPM assumes that market returns represent systematic risk. Recognizes multiple systematic risk factors. APT is supply side in that it usually includes macroeconomic factors.

Finance questions and answers. APT Models The issues with the CAPM have led researchers to develop models that add additional factors to. Solutions for Chapter 10 Problem 5CFA.

Recognizes multiple systematic risk factors. Recognizes multiple systematic risk factors E. The CAPM assumes that market returns represent systematic risk.

None of the above. Minimizes the importance of diversificationc. The APT differs from the CAPM because the APT.

APT assumes a few large changes are required to bring the market back to equilibrium. An investor takes as large a position as possible when an equilibrium price relationship is violated. The APT differs from the CAPM because the APT.

The APT differs from the CAPM because the APT a places more emphasis on market The apt differs from the capm because the apt a School University of New South Wales. Conversely the APT formula has multiple factors that include non-company. Recognizes multiple unsystematic risk factors D.

II III and IV d. Recognizes multiple unsystematic risk factors D. This is an example of.

Use of several factors instead of a single market index to explain the risk-return relationship. At first glance the CAPM and APT formulas look identical but the CAPM has only one factor and one beta. An important difference between CAPM and APT is A.

CAPM depends on risk-return dominance. Places more emphasis on systematic risk The CAPM assumes that market returns represent systematic risk. An important difference between CAPM and APT is both CAPM and APT depend on risk-return dominance CAPM assumes many small changes are required to bring the market back to EQ whereas APT assumes a few large changes are required to bring the market back to EQ.

Minimizes the importance of diversification C. Both the capital asset pricing model CAPM and the arbitrage pricing theory APT are methods used to determine the theoretical rate of return on an asset or portfolio but the difference between APT and CAPM lies in the factors used to determine these theoretical rates of return. Places more emphasis on market risk.

The feature of the APT that offers the greatest potential advantage over the CAPM is. Places more emphasis on market riskb. Minimizes the importance of diversification C.

That other macroeconomic factors may be systematic risk factors. Places more emphasis on market risk B. However the difference lies in the use of a single non company factor and a single measure of relationship between price of asset and the factor in the case of CAPM whereas there are many factors and also different measures of relationships between price of asset and different factors in APT.

Recognizes multiple systematic risk factors E. Recognizes multiple unsystematic risk factors. Which pricing model provide no guidance concerning the determination of the risk premium on factor portfolios.

CAPM assumes many small changes are required to bring the market back to equilibrium. The arbitrage pricing theory APT differs from the single-factor capital asset pricing model CAPM because the APT. Recognizes multiple systematic risk factors.

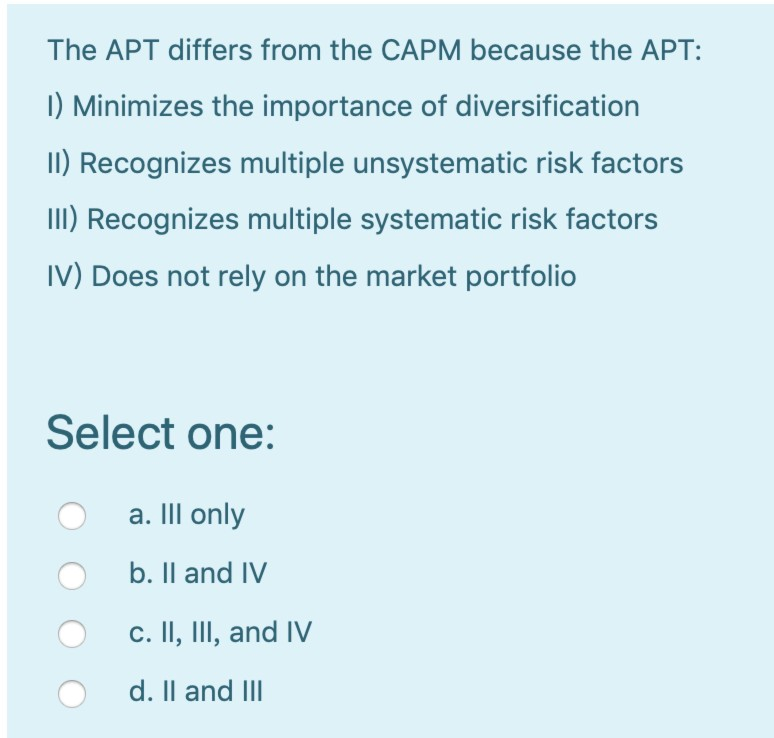

The APT differs from the CAPM because the APT _________. While all sources of risk were clubbed together in CAPM APT says that different securities have different sources of risk because of different exposure to the various factors. 1 Minimizes the importance of diversification I Recognizes multiple unsystematic risk factors I Recognizes multiple systematic risk factors IV Does not rely on the market portfolio Select one.

Places more emphasis on market risk. The Capital Asset Pricing Model CAPM is a special case of the Arbitrage Pricing Model APT in that CAPM uses a single factor beta as sensitivity to market price changes whereas the APT has multiple factors which may not include the CAPM beta. The APT differs from the CAPM because the APT _________.

The general arbitrage pricing theory APT differs from the single factor CAPM because APT. CAPM only looks at the sensitivity of the asset as related to changes in the market. Recognizes multiple systemic risk factors.

Il and IV C. Places more emphasis on market risk B. APT introduced the concept of factors in asset pricing where factors are quantified macroeconomic shocks.

The APT recognizes that other macroeconomic factors may be systematic risk factors. Minimizes the importance of diversification. D recognizes multiple systematic risk factors.

The APT differs from the CAPM because the APTA places more emphasis on market riskB minimizes the importance of diversification C recognizes multiple unsystematic risk factorsD recognizes multiple systematic risk factors. A places more emphasis on market risk B minimizes the importance of diversification C recognizes multiple unsystematic risk factors D recognizes multiple systematic risk factors E none of the above Answer. The APT differs from the CAPM because the APT _____.

APT depends on a no arbitrage condition. The CAPM assumes that the market returns. The APT differs from the CAPM because the APT A recognizes multiple systematic The apt differs from the capm because the apt a School University of Wisconsin Milwaukee.

Recognizes multiple unsystematic risk factors. The APT differs from the CAPM because the APT _____. The APT differs from the CAPM because the APT.

Minimizes the importance of diversification. APT in essence is a mere extension of CAPM.

Solved The Apt Differs From The Capm Because The Apt 1 Chegg Com

The Apt Differs From The Capm Because The Apt A Places More Emphasis On Market Course Hero

Comments

Post a Comment